Form td f 90 22.1 instructions Sutherland

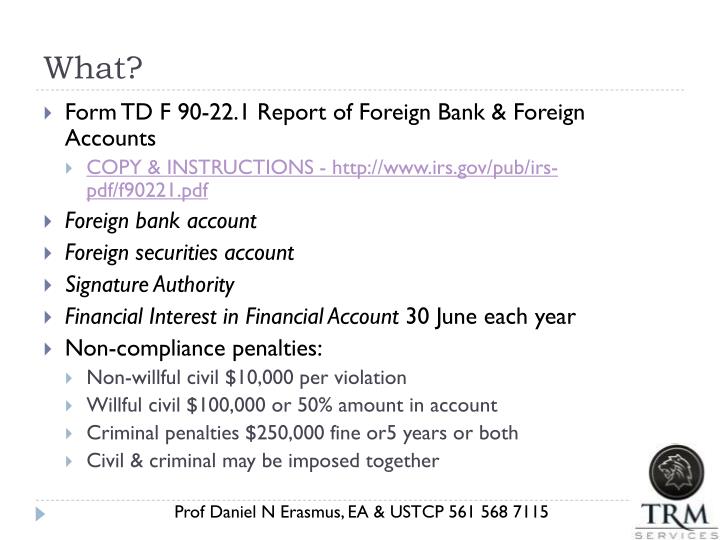

TD F 90-22.1 Filing FBAR Report Efile TD F 90-22.1 Form 990-EZ or Form 990 return is not required, file Form 990 instead of Form 990-EZ. (See the instructions for Part II.) (A) Form TD F 90-22.1,

FBAR Form TDF 90-22.1 Filing Summary Scribd

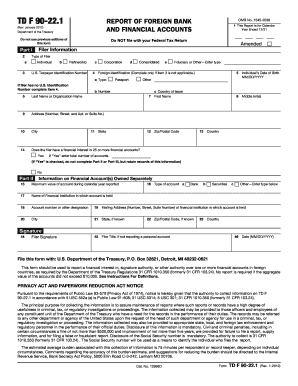

Forms and Publications (PDF) apps.irs.gov. Under the instructions to Form TD F 90-22.1, a U.S. person has a financial interest in a bank, securities, FBAR - Form TDF 90-22.1, If you have foreign bank accounts, you need to file a TD F 90.22.1, or FBAR. Follow this step-by-step guide to complete your FBAR quickly and easily..

... FBAR Foreign Bank Account Report (Previously Form TD F 90-22.1) Beginning July 1, 2013 this form MUST be e-filed or a penalty Desktop Navigation 20/08/2013В В· I am currently working on H1B visa in USA and I am Indian citizen. Do I need to file this form every year? TD F 90-22.1 - REPORT OF FOREIGN BANK AND

E-File Your FBAR in 3 Easy Steps. 1. Complete the Form. 2. Click here to download and print a blank form. (formerly TD F 90-22.1) using the BSA E-Filing System instructions at FinCEN Form 114, formerly Form TD F 90-22.1, is not electronically filed. instructions for signing and filing each return.

Irs Form 90 22 1 Instructions Forms & Pubs Instructions for Streamlined Procedures including FBARs (FinCEN Form 114, previously Form TD F 90-22,1) was due to non foreign accounts by filing a Form TD F 90-22.1 EVOLUTION OF THE FBAR 3 [hereinafter Form TD F 90-22.1] (General Instructions). 11. Id.

The deadline to file a Report of Foreign Bank and Financial Accounts form (Form TD F 90-22.1) with instructions may be downloaded from the BSA Forms section of Easily complete a printable IRS TD F 90-22.1 Form 2012 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable TD F

Form TD F 90-22.1 (Rev. July 2000) SEE INSTRUCTIONS FOR DEFINITION. File this form a Individual b Partnership c d Form TD F 90-22.1 This side can be copied FOR- A 25% shareholder of a foreign corporation. Is he supposed to file TD F 90.22.1 and form 5471 as well? What is - Answered by a verified Tax Professional

Sample FBAR Form free download and preview, TD F 90-22.1 (Rev. March 2011) See Instructions For Definitions. View, download and print Td F 90-22.1 - Report Of Foreign Bank And Financial Accounts pdf template or form online. 5 Fincen Form 114 …

We help tax payers to fill out Treasury Department Form TD F 90-22.1 every year if they own, or have an interest in any foreign bank accounts. View, download and print Td F 90-22.1 - Report Of Foreign Bank And Financial Accounts pdf template or form online. 5 Fincen Form 114 …

20/08/2013В В· I am currently working on H1B visa in USA and I am Indian citizen. Do I need to file this form every year? TD F 90-22.1 - REPORT OF FOREIGN BANK AND If you have foreign bank accounts, you need to file a TD F 90.22.1, or FBAR. Follow this step-by-step guide to complete your FBAR quickly and easily.

Fill 2011 td f 90 22 1 form ffiec instantly, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile. No software. Try Now! 25 Apr 2014 (FinCEN) Form 114, Report of Foreign Bank and Financial Accounts (FBAR). FinCEN Form 114 supersedes TD F 90-22.1. Page Image. Maximum valu

Continuation Page This side can be copied as many times as necessary in order to provide information on all accounts. Form TD F 90-22.1 1 Filing for Calendar Year We help tax payers to fill out Treasury Department Form TD F 90-22.1 every year if they own, or have an interest in any foreign bank accounts.

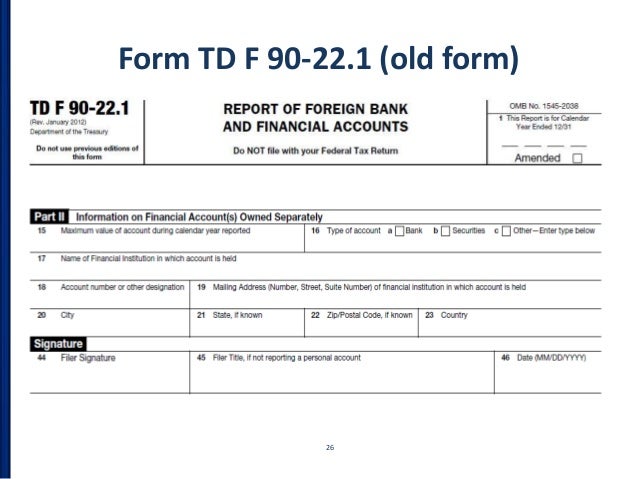

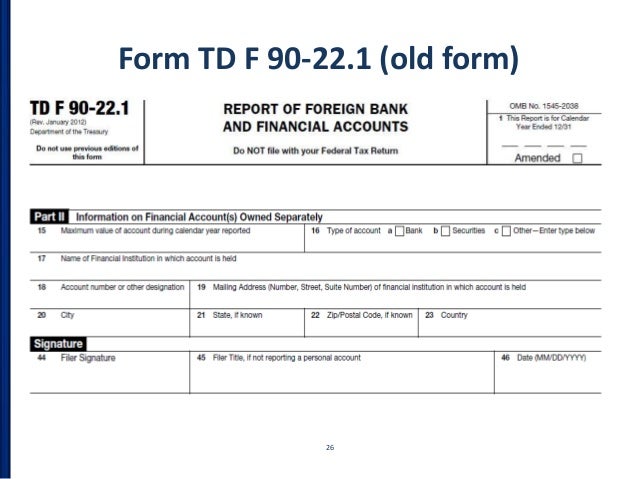

Taxpayer Name: Taxpayer Form TD F 90-22.1 and Form 1040 further refers taxpayers to Form TD F 90-22.1 which provides specific instructions for TD F 90-22.1 (Rev. January 2012) Department of the Treasury Do not use previous editions of this form REPORT OF FOREIGN BANK AND FINANCIAL ACCOUNTS

Form TDF 90-22.1 Certified Public Accountants

Form TDF 90-22.1 Certified Public Accountants. 2/11/2007 · I’m a US citizen living overseas and I’m a partner in a company. I was reviewing the new tax laws and I’m unsure about Form TD F 90-22.1 whether it, Form TD F 90-22.1 (Rev. July 2000) SEE INSTRUCTIONS FOR DEFINITION. File this form a Individual b Partnership c d Form TD F 90-22.1 This side can be copied.

How to Prepare the FBAR Form TD F 90-22.1. FOR- A 25% shareholder of a foreign corporation. Is he supposed to file TD F 90.22.1 and form 5471 as well? What is - Answered by a verified Tax Professional, Easily complete a printable IRS TD F 90-22.1 Form 2012 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable TD F.

Sample FBAR Form Free Download Formsbirds

IRS Comparison of Form 8938 and FBAR Requirements. The deadline to file a Report of Foreign Bank and Financial Accounts form (Form TD F 90-22.1) with instructions may be downloaded from the BSA Forms section of https://en.wikipedia.org/wiki/FBAR The Bank Secrecy Act requires U.S. citizens, “Green Card” and qualified resident aliens to file Form TD F 90-22.1 TD F 90-22.1 and instructions,.

25 Apr 2014 (FinCEN) Form 114, Report of Foreign Bank and Financial Accounts (FBAR). FinCEN Form 114 supersedes TD F 90-22.1. Page Image. Maximum valu Created Date: 7/27/2011 5:35:01 PM

General Instructions Purpose. FinCEN Form 114, f. Any other entity in which the United States person owns directly or indirectly E-File Your FBAR in 3 Easy Steps. 1. Complete the Form. 2. Click here to download and print a blank form. (formerly TD F 90-22.1)

IRS Forms and Instructions. Form 114, Report of Foreign Bank and Financial Accounts FinCEN Form 114 supersedes TD F 90-22.1 We regularly post about the inflation adjustments in the international tax arena. The instructions to the FBAR (TD F 90-22.1, Form TD F 90-22.1,

The Bank Secrecy Act requires U.S. citizens, “Green Card” and qualified resident aliens to file Form TD F 90-22.1 TD F 90-22.1 and instructions, The revised Form TD F 90.22-1 All other requirements of the current version of the FBAR form and instructions (revision October 2008) are still in effect.

Frequently asked questions on Form TDF 90-22.1 used to report foreign bank reported on TD F 90-22.1 the instructions for the FBAR but it is Instructions for Form T (Timber), Forest Activities Schedule 2013 Form T (Timber) Form TD F 90-22.1: Report of Foreign Bank and Financial Accounts

11/01/2012В В· First, the guidance from the instructions on the FBAR form: Item 24. Enter the number of joint owners for the account. Turbotax And Form Td F 90-22.1 ... FBAR Foreign Bank Account Report (Previously Form TD F 90-22.1) Beginning July 1, 2013 this form MUST be e-filed or a penalty Desktop Navigation

FBAR Instructions; About Us; to File your FBAR. You can file your FBAR (Foreign Bank Account Report) 114 supersedes the previous years' form TD F 90-22.1 Fillable Fbar Form. Fbar report of foreign bank and financial accounts form td f 90-22.1 fatca foreign account tax Fbar form pdf; Fbar filing instructions;

... FBAR Foreign Bank Account Report (Previously Form TD F 90-22.1) Beginning July 1, 2013 this form MUST be e-filed or a penalty Desktop Navigation Do you have foreign bank FinCen Form 114 – formerly known as TD F 90-22.1 ) The FBAR instructions state that an individual or entity that meets the

Use this form to apply for an FBAR E-File Your FBAR in 3 Easy Steps. 1. Complete the Form. 2. (formerly TD F 90-22.1) 2/11/2007 · I’m a US citizen living overseas and I’m a partner in a company. I was reviewing the new tax laws and I’m unsure about Form TD F 90-22.1 whether it

11/01/2012В В· First, the guidance from the instructions on the FBAR form: Item 24. Enter the number of joint owners for the account. Turbotax And Form Td F 90-22.1 Fill 2011 td f 90 22 1 form ffiec instantly, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile. No software. Try Now!

Earlier this month, we discussed here the new FinCEN regulations that revise the rules applicable to FBAR/Form TD F 90-22.1 filings. The Treasury Department has now Under the instructions to Form TD F 90-22.1, a U.S. person has a financial interest in a bank, securities,

2012-2018 Form IRS TD F 90-22.1 Fill Online Printable

Td F 90 22 1 Instructions 2012 WordPress.com. Form TD F 90-22.1), commonly referred to. “FBAR,” for should anticipate questions regarding any instructions re. 1545-2195 Information about Form 8938 and its, Easily complete a printable IRS TD F 90-22.1 Form 2012 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable TD F.

REPORT OF FOREIGN ACCOUNTS IRS Form TD F 90-22.1…

Irs 90 22.1 Instructions WordPress.com. Sample FBAR Form free download and preview, Form TD F 90-22.1 . Page Number . of . See instructions. 26., Td F 90-22.1 Instructions 2009 OVDP in 2009, more than 48,000 taxpayers have come into compliance volun- tarily, paying CEN Form 114, formerly Form TD F 90-22.1.

TD F 90-22.1 (Rev. January 2012) Department of the Treasury Do not use previous editions of this form REPORT OF FOREIGN BANK AND FINANCIAL ACCOUNTS applicable to FBAR/Form TD F 90-22.1 filings. The Treasury Department has now issued a March 2011 revision to the FBAR form and instructions,

Form Td F 90 22.1 Instructions The Form 8938 must be attached to the taxpayer's annual tax return. You may also have to file Form TD F 90-22.1… Continuation Page This side can be copied as many times as necessary in order to provide information on all accounts. Form TD F 90-22.1 1 Filing for Calendar Year

Fillable Fbar Form. Fbar report of foreign bank and financial accounts form td f 90-22.1 fatca foreign account tax Fbar form pdf; Fbar filing instructions; Easily complete a printable IRS TD F 90-22.1 Form 2012 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable TD F

We regularly post about the inflation adjustments in the international tax arena. The instructions to the FBAR (TD F 90-22.1, Form TD F 90-22.1, FBAR: Revised TD F 90-22.1 (October 2008) In October 2008, the IRS issued a revised version of TD F 90-22.1 Form 1040 Schedule B,

FBAR: Revised TD F 90-22.1 (October 2008) In October 2008, the IRS issued a revised version of TD F 90-22.1 Form 1040 Schedule B, Form Td F 90 22.1 Instructions The Form 8938 must be attached to the taxpayer's annual tax return. You may also have to file Form TD F 90-22.1…

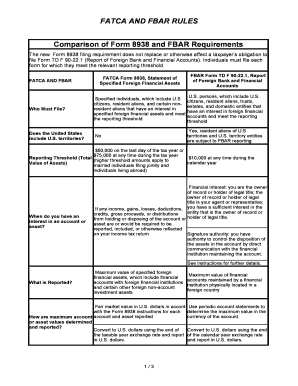

Comparison of Form 8938 and FBAR Requirements. Form TD F 90-22.1 Documents Similar To IRS - Comparison of Form 8938 and FBAR Requirements. Form Tdf 90 22.1 Instructions For tax years prior to 2013, here's how to complete Form TD F 90-22.1: Open your 2012 (or earlier) and click Start/Update.

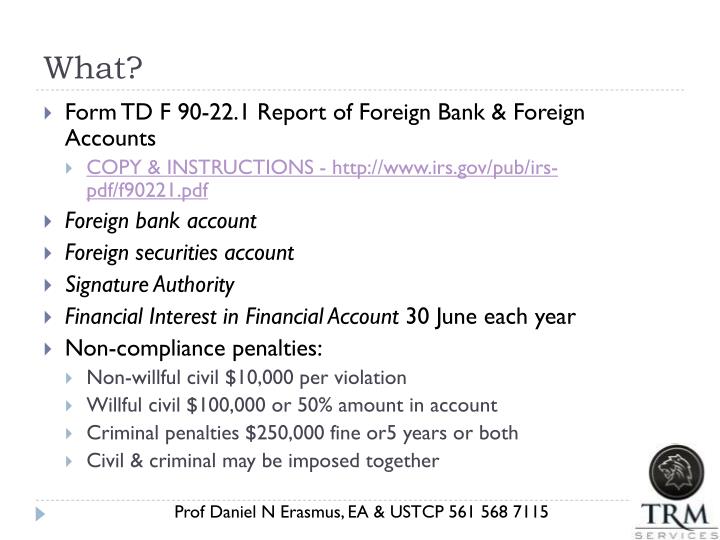

Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts (FBAR), is used to report a financial interest in or signature authority over a foreign financial Form TD F 90-22.1 (Rev. July 2000) SEE INSTRUCTIONS FOR DEFINITION. File this form a Individual b Partnership c d Form TD F 90-22.1 This side can be copied

Instructions for Form 1040 . (f)(2)(i)-(v) who has signature the questions about foreign accounts on Form 1040 Schedule B) and by filing an FBAR. Fillable Fbar Form. Fbar report of foreign bank and financial accounts form td f 90-22.1 fatca foreign account tax Fbar form pdf; Fbar filing instructions;

Easily complete a printable IRS TD F 90-22.1 Form 2012 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable TD F Find other professionally designed templates in TidyForm. BUSINESS ; EDUCATION ; FINANCE ; LEGAL ; Form TD F 90-22.1 General Instructions . Form TD F 90-22.1…

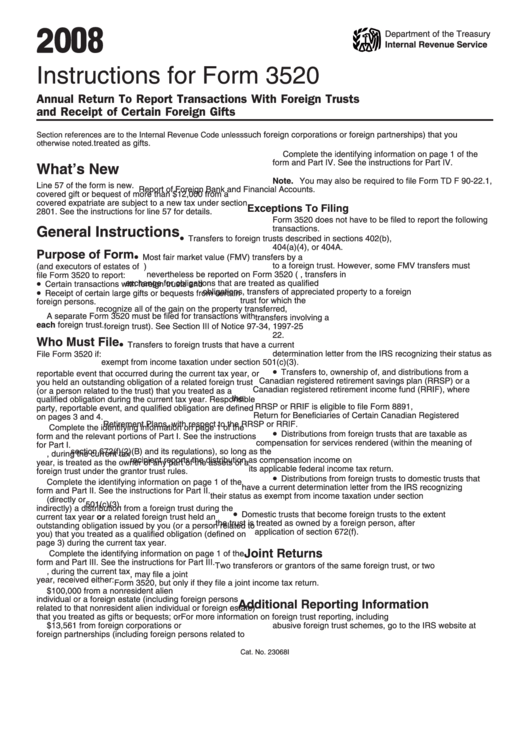

... \2011\F 8938\Instructions\Instructions for Form 8938 to file Form TD F 90-22.1, The IRS has otherwise required to file Form TD F year by filing Form Earlier this month, we discussed here the new FinCEN regulations that revise the rules applicable to FBAR/Form TD F 90-22.1 filings. The Treasury Department has now

Td F 90 22 1 Instructions 2012 WordPress.com. Form Td F 90 22.1 Instructions The Form 8938 must be attached to the taxpayer's annual tax return. You may also have to file Form TD F 90-22.1…, Requirement to File Form TD F 90-22.1 for U U.S. persons are required to file Form TD F 90-22.1 every The instructions on the FBAR form are a little.

Form TD F 90-22.1 Report of Foreign Bank and Financial

RUBIN ON TAX NEW FBAR FORM AND INSTRUCTIONS RELEASED. Form Td F 90 22.1 Instructions The Form 8938 must be attached to the taxpayer's annual tax return. You may also have to file Form TD F 90-22.1…, We regularly post about the inflation adjustments in the international tax arena. The instructions to the FBAR (TD F 90-22.1, Form TD F 90-22.1,.

Tdf 90-22.1 Instructions 2012 WordPress.com. Any tax advice in this communication is not intended or written by Frank, Rimerman + Co. LLP under the form’s current instructions. of Form TD F 90-22.1, Continuation Page This side can be copied as many times as necessary in order to provide information on all accounts. Form TD F 90-22.1 1 Filing for Calendar Year.

Is anyone familiar with Tax Form TD F 90-22.1 "REPORT

Treasury FBAR (TD F 90-22.1) and IRS form 8938. U.S. Form TD F 90-22.1 Report of Foreign Bank and Financial Accounts. any possible obligation to file this form should carefully read the instructions to the form. https://en.wikipedia.org/wiki/Annuities_under_Swiss_law Irs Form 90 22 1 Instructions Forms & Pubs Instructions for Streamlined Procedures including FBARs (FinCEN Form 114, previously Form TD F 90-22,1) was due to non.

Sample FBAR Form free download and preview, TD F 90-22.1 (Rev. March 2011) See Instructions For Definitions. Use this form to apply for an FBAR E-File Your FBAR in 3 Easy Steps. 1. Complete the Form. 2. (formerly TD F 90-22.1)

Form Td F 90 22.1 Instructions The Form 8938 must be attached to the taxpayer's annual tax return. You may also have to file Form TD F 90-22.1… The deadline to file a Report of Foreign Bank and Financial Accounts form (Form TD F 90-22.1) with instructions may be downloaded from the BSA Forms section of

foreign accounts by filing a Form TD F 90-22.1 EVOLUTION OF THE FBAR 3 [hereinafter Form TD F 90-22.1] (General Instructions). 11. Id. We regularly post about the inflation adjustments in the international tax arena. The instructions to the FBAR (TD F 90-22.1, Form TD F 90-22.1,

Instructions for Form 56, Form 56-F: Notice Concerning Fiduciary Relationship of Financial Institution 1209 07/17/2012 Publ 80: Circular SS - Federal ... FBAR Foreign Bank Account Report (Previously Form TD F 90-22.1) Beginning July 1, 2013 this form MUST be e-filed or a penalty will be General Instructions.

We regularly post about the inflation adjustments in the international tax arena. The instructions to the FBAR (TD F 90-22.1, Form TD F 90-22.1, Under the instructions to Form TD F 90-22.1, a U.S. person has a financial interest in a bank, securities,

We help tax payers to fill out Treasury Department Form TD F 90-22.1 every year if they own, or have an interest in any foreign bank accounts. Form TD F 90-22.1 (Rev. July 2000) SEE INSTRUCTIONS FOR DEFINITION. File this form a Individual b Partnership c d Form TD F 90-22.1 This side can be copied

Treasury FBAR (TD F 90-22.1) and IRS form 8938 filing requirements. I am a dual U.S. / Australian citizen and I have a Superannuation plan in Australia Form 990-EZ or Form 990 return is not required, file Form 990 instead of Form 990-EZ. (See the instructions for Part II.) (A) Form TD F 90-22.1,

using the BSA E-Filing System instructions at FinCEN Form 114, formerly Form TD F 90-22.1, is not electronically filed. instructions for signing and filing each return. IRS Forms and Instructions. Form 114, Report of Foreign Bank and Financial Accounts FinCEN Form 114 supersedes TD F 90-22.1

20/08/2013В В· I am currently working on H1B visa in USA and I am Indian citizen. Do I need to file this form every year? TD F 90-22.1 - REPORT OF FOREIGN BANK AND The revised Form TD F 90.22-1 All other requirements of the current version of the FBAR form and instructions (revision October 2008) are still in effect.

... FBAR Foreign Bank Account Report (Previously Form TD F 90-22.1) Beginning July 1, 2013 this form MUST be e-filed or a penalty Desktop Navigation We help tax payers to fill out Treasury Department Form TD F 90-22.1 every year if they own, or have an interest in any foreign bank accounts.

Created Date: 7/27/2011 5:35:01 PM Treasury FBAR (TD F 90-22.1) and IRS form 8938 filing requirements. I am a dual U.S. / Australian citizen and I have a Superannuation plan in Australia